100 transactions in 1,000 days for +100% annual returns

Posted by OnMarket 25 September 2018 @ 12:00am IPOs

A message to our supporters and our amazing team,

Every 10 days for the last 1,000 days, you have:

- Helped an Australian company build a business by providing the equity funding they need

- Created new jobs for Australians in growth industries

- On boarded +450 new OnMarket members

- Processed +320 individual applications for shares

- Raised +$650,000 from investors

About 1,000 days ago the Prime Minister launched our OnMarket App. No pressure when the PM says that ‘the brilliance of this App is that it will open up the investment market considerably’. Ticky Fullerton had a cheeky go, asking how his old partners at Goldman Sachs would feel about it.

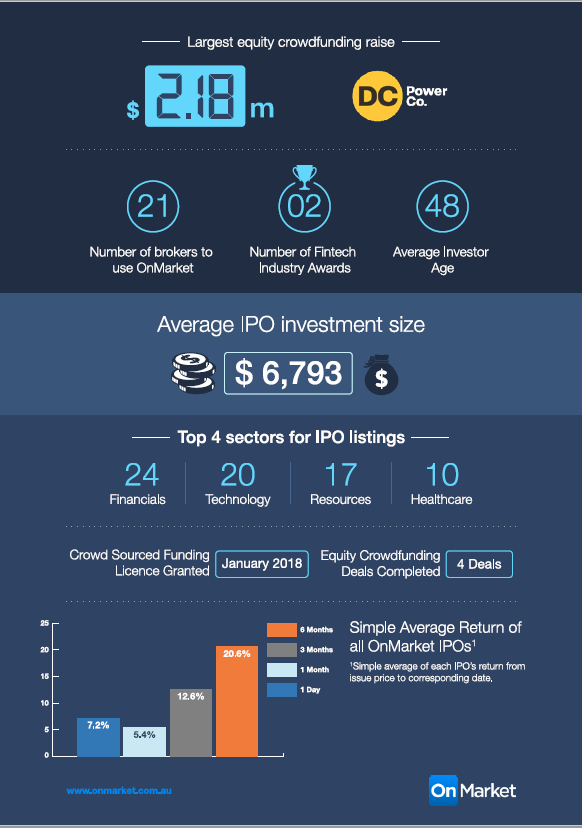

So, here we are. Nearly 50,000 investors have joined the platform, we’ve processed +32,000 applications, and raised more than $65 million. Eighty of those companies have listed on the ASX, raising a further $700 million (and that excludes the LICs). These are real operational businesses.

Here at OnMarket, we’re trying to take a different approach. While the public’s been aghast at the jaw-dropping, fee-gouging, conflicts exposed by the Royal Commission, we’ve been steadily beavering away. We have no conflicts. What have we charged you, our OnMarket members? Zip. Zero. Nada. How novel.

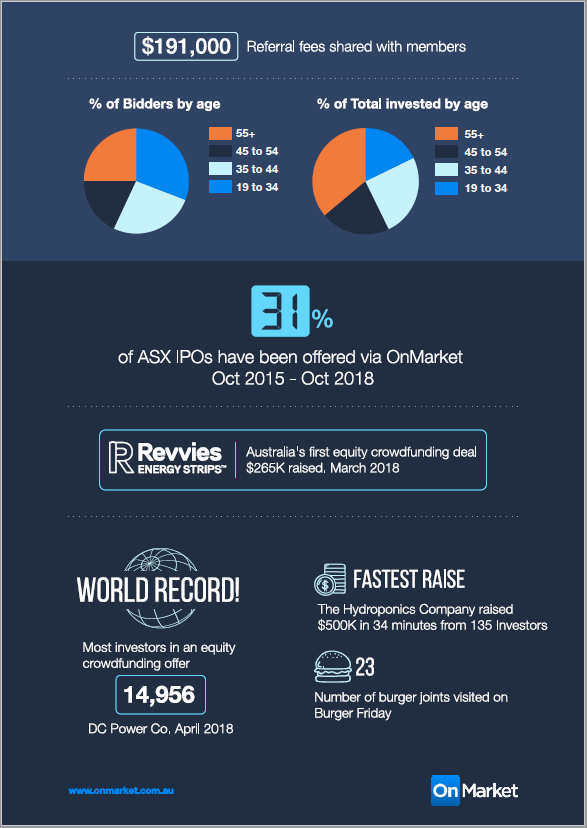

Actually, we’ve paid +$190,000 in cash payments to our members for referring people. We pay 25% of our stamping fee, automatically, on any deals that people that they have referred participate in, for the first 2 years.

I reckon the 100 companies we’ve helped raise funds have created at least as many jobs as a certain proposed coal mine. Imagine what we could do with a loan to really supercharge jobs growth and increase private investment in the companies that will be Australia’s future stars. Anyone want to have a quiet word in the ear of the Treasurer?

Initial Public Offerings (IPOs)

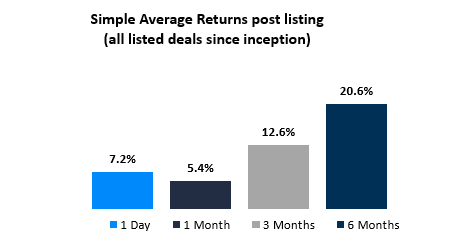

As you’d expect from companies chasing high growth, some of the companies offered OnMarket have crashed and some have soared. A few have done both. But, for the stalwarts, the people that have patiently put $2,000 (or just the same investment amount for that matter) into every IPO…well, here’s what it looks like.

When thinking about returns and how to compare them with other investments, it’s very important to keep in mind two things: risk and ‘time money invested’. There is a significant range of returns in each individual IPO in each of these time horizons. We publish a full list here, updated each month. We think that the best way to address the risk of not being in the winners is diversification.

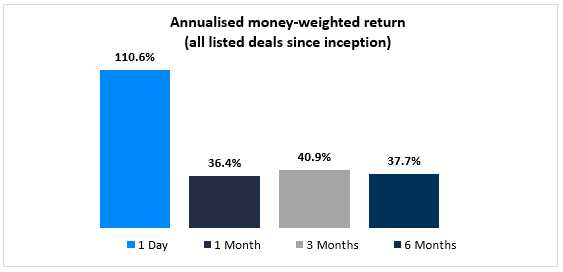

‘Time money invested’ is important, because most funds quote annual returns over 1, 3, 5 and ‘life-of-fund’ periods. In contrast, the returns above are over much shorter periods.

This next diagram assumes a $2,000 investment (or for that matter any investment of the same size) in every deal, selling on the following dates post-listing:

For those that love maths please see the Footnote that works through the methodology surrounding the calculation in this diagram.

The returns in this diagram are based on the closing price on the relevant day. There’s no guarantee that there would be liquidity to execute larger stakes at that price, and of course, some IPOs are scaled back (although never below $2,000 minimum subscription). So, I’d say that’s a pretty good answer to the doubters, no? With over 80 IPOs/listed capital raisings in the data set, and including every deal (yes, even the awful ones), we think it’s pretty good evidence of the systemic returns available to investors.

Does this mean that you should try to sell on the first day? Well, not necessarily. The time-weighted risk variation of returns reduces as the time period increases. But that’s a whole new subject in itself for another day. Brilliant quants, apply here.

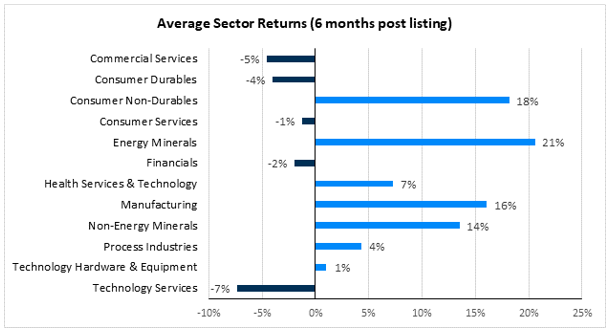

For those that are wondering where the performance has come from, here is a breakdown:

Of course, some people will say that the real money has been made prior to companies listing on the sharemarket. And, there’s some truth in that. Investing in an early stage of a business is naturally riskier, and investors that take on that risk can have exceptional returns if they have invested in the right companies. It’s called Angel investing for a reason!

Have you been getting our offers that are exclusive to sophisticated, professional or experienced investors? If not, you can log onto OnMarket, go to your investor profile section to see whether you are legally eligible to register for these exclusive offers.

Equity Crowdfunding

Under new regulations, companies with less than $25 million in revenue and assets can now raise money from investors without issuing a prospectus. That’s called equity crowdfunding. The UK has been given a massive 6 year head start on Australian companies. But, finally, this month, new legislation extends the equity crowdfunding exemption to Pty Ltd Companies. This removes a significant burden for prospective issuers.

In April, we completed the largest equity crowdfunding in the world, by number of investors. The previous largest attracted 6,500 investors. We managed to attract close to 15,000 investors into a seed round in a month. That’s right, a seed round.

For that raising, the company was seeking as many investors as possible, rather than to raise the maximum funds possible. Although they did raise $2.18 million, for the company getting investor buy-in was the main goal as a first step in building a customer database. Getting close to 15,000 people to invest is not a bad way for a start-up, seed-stage company to understand their target market prior to spending up big!

For many B2C companies, equity crowdfunding translates not only to investment dollars, but also to new business opportunities. Keep an eye out for PT Blink. Certainly, they had a huge spike in business as a result of their equity crowdfunding campaign.

Of course, some companies will want to keep their share register small, and just bring in the big cheques. That’s an option too. The minimum investment size is set by us and the company to achieve their goals. When we review and advise on constitutions and shareholder agreements, we seek to find the right balance between enabling minority shareholders to share in the upside and are protected from misuse of funds and providing founders and management with enough rope to get on with the business.

So, to all those people that have invested via OnMarket. Thank you! We hope that you’ve been on the winners, or at least the averages.

For those that haven’t invested by now…well, if you are still getting these emails but not invested…I really don’t know what it’s going to take. If you have shared via the OnMarket referral panel, and been reaping some of the +$190,000 that we’ve paid out, thanks. After all, without you, the investors, none of this would be possible.

See you OnMarket,

Ben Bucknell

Footnote (for those that love maths): A dollar-weighted return measures investment performance taking account of the size and timing of cash flows. Performance is calculated daily by an independent 3rd party app, Sharesight. Sharesight annualises returns weighting the length of time that each capital input has been invested for, by the amount of capital invested to determine the average years invested (AYI) for each dollar of capital. This is generally accepted as the most appropriate calculation for self-directed investors.